N

ational Football League team values have plateaued.

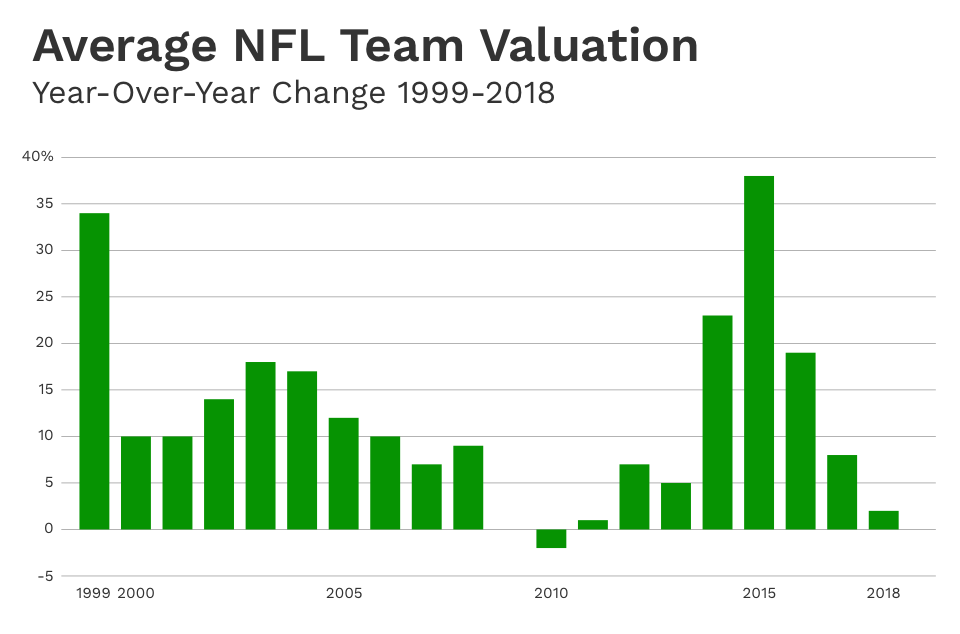

On average, values increased 2% during the past year, to $2.57 billion. It was the smallest increase since 2011, when values increased an average of 1.4%. Adjusted-for-inflation values fell by 0.7% this year.

Main reason: the dearth of people who have the liquid wealth to buy 30% of an NFL team. When Jerry Richardson put the Carolina Panthers up for sale after last season, some pundits were predicting the team could go for $3 billion. Billionaire David Tepper got the team for $2.3 billion because he was the only person sitting at the table with enough cash to satisfy the league’s financing rules.

The NFL has the strictest ownership requirements among the four major U.S. leagues. In a team sale, the general partner must own at least 30%, and the maximum amount of debt at the team level is $350 million. If a team is sold for $2.3 billion, for example, the minimum equity by the GP would be $585 million, assuming the maximum amount of debt has been secured for the team by the GP.

In other words, it takes much more than being a member of the Forbes 400, where many fortunes have been made via real estate or privately run companies. It takes liquid wealth.

Andres Jauregui

One reason this has become an increasingly hard pill for one person to swallow is the contrast between the long-term performance of the stock market (a key source of liquid wealth) and football team values. During the past 20 years NFL team values have climbed almost ninefold, or at an 11.6% annual rate, versus just 4.5% for the S&P 500.

Moreover, no corporate ownership is allowed in football. And NFL rules stipulate there can be a maximum of 24 limited partners. So, in the aforementioned example, the LPs would have to throw in $1.37 billion and get no say in how the team is run.

Put another way, the $1.2 billion sale of the Miami Marlins would have never passed muster in the NFL.

The NFL’s financing rules have been effective. The league has not had a team in financial trouble due to too much debt since 1999, when Art Modell agreed to sell the Baltimore Ravens to Stephen Bisciotti. There have been no Los Angeles Dodgers, New Orleans Hornets or Arizona Coyotes fiascos in the NFL. None of that.

The NFL, already the biggest ($427 million per team average revenue) and most profitable (operating income of $95 million per team) league in the world, will soon become even richer.

The NFL can opt out of the Sunday Ticket deal with AT&T’s DirecTV in 2019, four years early. The current deal, worth an average of $1.5 billion to the NFL per year, was 50% more than the previous agreement.

The bidding for Sunday Ticket will be hot. Walt Disney’s ESPN and Amazon are likely to be interested, given their push toward streaming sports. Meanwhile, the league has been making it easier for its consumers to stream NFL content. I think the annual average value of the next Sunday Ticket deal could be twice the existing one.

Jerry Jones owns the Dallas Cowboys—the first team in any sport worth $5 billion.

Matt Hawthorne Photography

Dallas Cowboys owner Jerry Jones recently said, “Legalized gambling is going to increase the amount of time people spend watching the NFL on television and online, and therefore it is going to have a very positive impact on the value or our content.”

As a result, barring any changes in ownership and financing rules, the schism between the NFL’s economics and team sale prices will probably widen. Which isn’t necessarily a bad thing.

A few notes on our methodology:

Revenues and operating income (earnings before interest, taxes, depreciation and amortization) are for the 2017 season and net of stadium debt service. Debt includes both team and stadium debt recourse to team owners. We employ the cash basis, rather than the accrual basis, of accounting.

Team values are enterprise value (equity plus net debt) and include the economics of the team’s stadium but not the value of its real estate.

For teams building new stadiums, like the Los Angeles Rams and Oakland Raiders, values are based on estimates of revenue in their new stadiums.

Forbes

Reach Mike Ozanian at mozanian@forbes.com. Cover image by Steven Puetzer.